Countries That Have High Rates of Savings Also Have

The Highest Interest Rates in the World. Countries that have higher saving rates are likely to have Multiple Choice A higher investment rate as a percentage of GDP and a lower growth rate of real GDP.

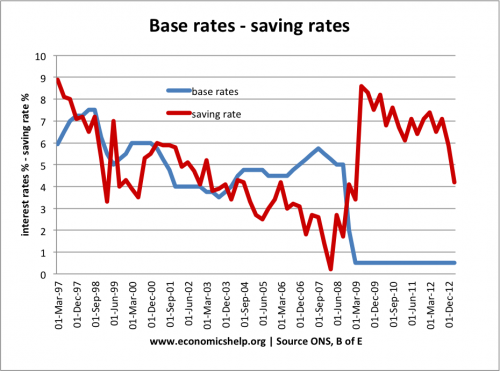

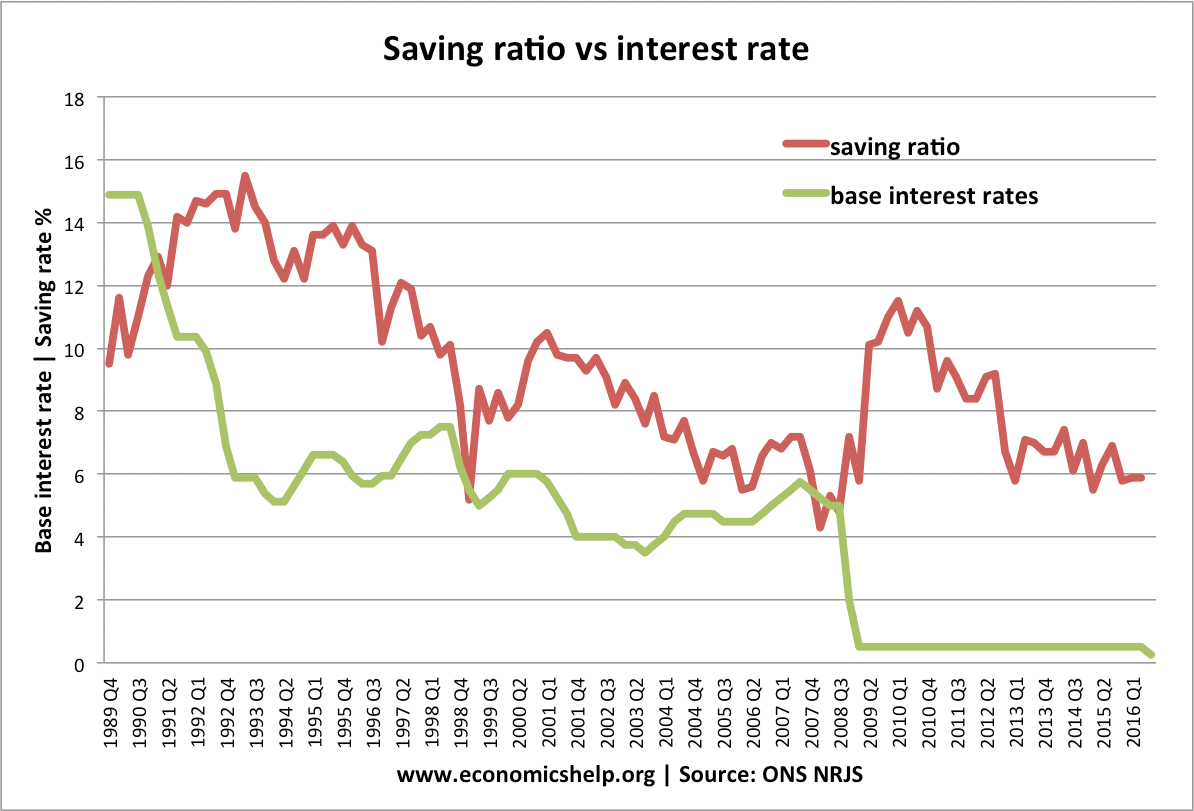

How Do Interest Rates Affect Savers And Saving Levels Economics Help

Below we have taken a look at the economies with the lowest gross national savings.

. If youre trying to get a better return in foreign banks you have a lot more factors to consider than just the interest rate. Half of the top 10 countries listed here have native savings rates above 40 of GDP while the other half have rates of 34 to 38. There were banks in India offering 10 interest on savings accounts which sounds incredible until you learn that inflation in India has been upwards of 12 in recent years.

Americans pay almost 4 a gallon for gas. Another reason savings rates vary from country to country may have to do with the fixed cost of living. In some countries gasoline costs twice that much.

If countries have similar factors of production and similar productivities most of their trade is likely to be intraindustry. India tends to have rates hovering around 95 for INR but are practically accessible only to Indian citizens. In some countries gasoline costs twice that much.

There are a few developed countries that also have high saving rates. The Danish central bank started off 2015 by slashing interest rates several times to the point where they are now also at -075. As bad as the US.

Countries that have high rates of savings also have. Australia will also up its game at 1210. At Least Americans are not Dead Last.

High savings rates lead to high stability and a strong and durable government and economy. Generally speaking does receiving a higher interest rate mean that you should open an account. These are usually hard to access currencies - Brazil and Iceland tend to have high rates and can be accessed by foreigners with some trouble.

Countries that are abundant in valuable natural resources such as highly fertile land or rich mineral deposits have higher real GDP per capita than less fortunate countries. A higher investment rate as a percentage of GDP and a higher growth rate of real GDP. This page provides values for Personal Savings reported in several countries.

Maybe thats why they are the banking capital of the world. Argentina Brazil Colombia and Venezuela saved 1622 17 and 24 respectively. Asian countries as a whole are on a slight uptrend in national savings rates but peaked either in 2007-2008 or 2010 see Chart 1.

A lower Investment rate as a percentage of GDP and a lower growth rate of real GDP. Americans pay almost 4 a gallon for gas. Were Korea Malaysia and Indonesia outliers.

The table has current values for Personal Savings previous releases historical highs and record lows release frequency reported unit and currency plus. In particular it is assumed that government. You might be wondering if rates are better in other countries.

In detail here are the specific numbers. Consider that the national average interest rate for savings accounts is a mere 006 according to the Federal Deposit Insurance Corp. One of the distinguishing characteristics about capital mobility today is that.

Although Guineas economy was challenged by a recent Ebola. Now a few honorable mentions if you can make them work. Checking savings money market account and CD interest rates in the United States are low.

Interest Rates Today. Asia The Philippines China and Singapore have the highest savings rates ranging from 45-49 whereas the savings rates for all other Asian countries clusters around 28-35. Many Danish citizens now have to pay interest on any.

A distinction is made between private and government savings using panel data for 36 countries from 1970 to 1992. Another reason savings rates vary from country to country may have to do with the fixed cost of living. Personal saving rate looks its not the worst.

Among the countries registering the lowest gross national savings Guinea ranks first with a relative GNS of -149 of GDP according to Central Intelligence Agency CIA data. Is set for a savings rate of around 4. For comparison saving rates were 16 in the United States and 32 in Japan.

High rates of investment. In 2013 the savings rate from the most notable countries were. Finding a Country Where You Can Get Higher Interest Rates.

Why do the developing countries in Asia save so much. What can we take away from this data. Other mountains with a national savings rate in the 30 or higher range of GDP include Sri Lanka Norway India Indonesia Macedonia Netherlands Kyrgyz Republic and Sweden.

Growth in East Asia All the sources of productivity are rising they saved money and they had a high level of productivity as they adopted technological advances. The highest saving rate for a Latin American developing country was 26 for Mexico. Outbreak in Guinea.

This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - Personal Savings. Canada is set for a savings rate of 43 and the US. Each year there seems to be a new country that joins the ranks of the highest interest rate jurisdictions.

In years past Mongolia Zambia Turkey and Georgia have all topped the charts. This paper analyzes the determinants of savings in the world economy and discusses why saving ratios have been so uneven across countries. Most notably Switzerland which saves in the range of 10-30 of its income depending on which source you use.

Countries with the Highest Savings Rates Switzerland.

How Do Interest Rates Affect Savers And Saving Levels Economics Help

These Countries Offer The Highest Interest Rates Today Interest Rates Loan Interest Rates Country

0 Response to "Countries That Have High Rates of Savings Also Have"

Post a Comment